Geographies of Tech Wealth: San Francisco to "Silicon Border"

/As the companies, workers and wealth of Silicon Valley creep north into the city of San Francisco, the effects of an industry with a relatively small but highly paid labor force are leading to widespread social unrest. Embodied in the symbolic protests around “Google Buses,” lower-income residents are reacting to tech’s ability to produce so much wealth that is thinly distributed to a small labor force, disinvested from local infrastructure (with private transportation), and funneled to comically useless purposes like the “Google Barges” mysteriously floating in the Bay. However, conversations about tech wealth are often limited to its distribution—with even mainstream economists (as well as The Economist) conceding that, “Facebook will never need more than a few thousand employees.” Clearly, the other side of this is production; even with its relatively small labor force, Facebook can generate billions in wealth and profits. Instagram, the hip photo sharing mobile application, famously had only 13 employees when it sold for $1 billion (that’s around $77 million per employee).

What is going on is not only a lack of distribution but an industry’s ability to generate massive profits without the need of a sizable labor force.

San Francisco: Canary of “Wageless Life”

If Detroit is the metropolitan victim of “deindustrialization,” then San Francisco is the victor of the “high-tech economy.” But the centrality of San Francisco in new modes of profitability is experienced in highly unequal ways. While the clashes between long-time residents and the inflow of high-wage “techies” are amplified by the geographic constraints of the San Francisco peninsula, this isn’t just a story about inequality, nor about a lack of housing supply as some cheekily imply.

More than inequality, San Francisco’s unrest stems from a population facing an economy that no longer needs them. Those being evicted from communities of color are not only facing gentrification but also perpetually low-wage labor in an economy that doesn’t need them to produce competitive profits.

Economist and presidential advisor Larry Summers made headlines early this year when he shared his fears of “secular stagnation”--effectively insufficient demand to grow the economy. But as Michigan economic sociologist Greta Krippner has pointed out, this is not a new process, since the rise of “financialization” in the 1980s was already a response to the economic stagnation that began in the 1970s in the U.S. It is in the context of what appears to be the geographic limits on U.S. profits (because of limits of domestic demand, global competition, and over production) that tech provides an avenue for profitability relatively unencumbered by the physical constraints of labor and time.

Working hand in hand with financial speculation, tech is the new industry with the promise of fixing the West’s “New Growth Conundrum.” Chillingly, as the eviction of Bay Area workers foreshadows, a larger economic transition may push a significant part of the domestic labor toward what Yale historian Michael Denning has called “wageless life.” For Denning, these are workers who are a “relatively redundant population,” or to borrow a term from a different context, “populations with no productive function [in the tech economy].” Demand doesn't seem to be the root problem as Summers suggests, as expansions in credit access and the household debt burden have long buttressed wageless demand.

Some might note that high-wage jobs in San Francisco aren’t the only jobs generated by the tech economy. This is true, and following the money of the information economy eventually leads one abroad.

“Silicon Border” and Microwork: The Travels of Tech Wealth

To say that tech and the information economy do not distribute wealth is not to deny that it travels. Of course, venture investments and speculative growth are enabled by flows of global capital. However, equally dynamic is the outsourced production of microchips and the novel “Impact Sourcing” or socially targeted “microwork,” both of which skip the domestic U.S. labor force and seem to be jumping directly to the global South, pre-branded as a poverty solution too!

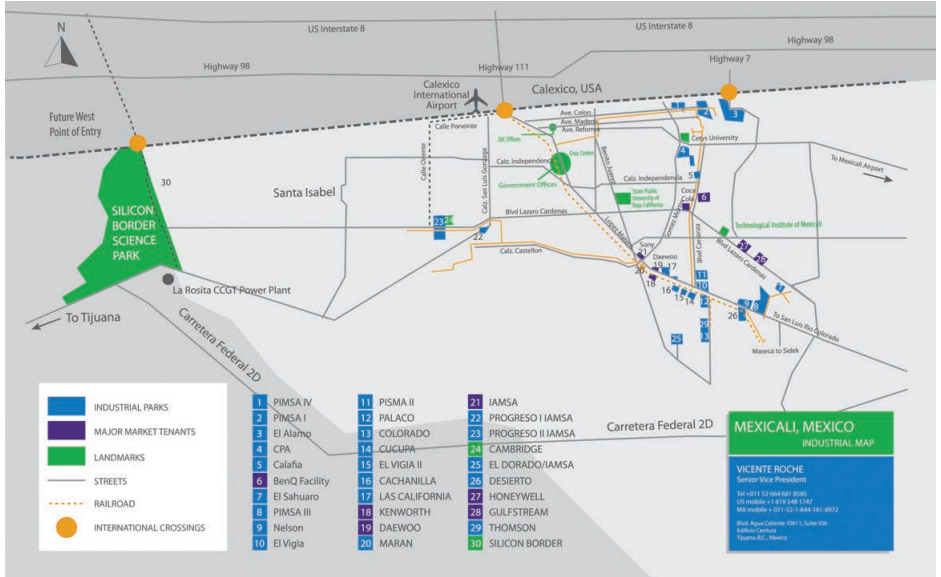

Tech wealth, in the form of wages, is distributed to somewhat familiar outsourced manufacturing sites. One peculiar example of tech wealth’s international travels is a 4,500-acre free enterprise zone in development not a mile south of the U.S.-Mexico border outside Mexicali. Dubbed “Silicon Border,” this commercial development is managed by the firm Jones Lang LaSalle, whose website prominently features their “2014 World’s Best Outsourcing Advisors” recognition.

Rendering of phase 1 of Silicon Border development, to include a “Science Park” as well as housing and a commercial units. Source: Silicon Border.

Marketing its first of four phases, investors seeks to attract tech industrial work for semiconductor manufacturing, boasting the site’s “Asian manufacturing cost structure in strategic North American location, [Mexican] Government incentives ranging from tax holidays […] free trade zone status […] with USA and 43 additional countries [and] access to reliable electric power, fresh water, waste water treatment and fire suppression systems [in the middle of the Yuma desert].”

Map produced by Silicon Border developers shows the massive scale of the development when compared to Mexicali, with a population of 700,000. Also, blue boxes represent other, smaller, manufacturing parks all built along international railways and international ports of entry. Source: Silicon Border.

If Silicon Border represents an adaptation of well-known models of securing cheap manufacturing labor abroad, the novel emergence of “microwork” is outsourcing with a social conscious. Microwork initiatives operating globally seek to build a business model around recruiting un- or underemployed workers to perform simple data-based tasks online (think of it as a global information assembly line). While the microwork model is in its infancy, it has already attracted companies like LinkedIn, Google, and Microsoft to this “pay-as-you-go” labor model. Differentiated from outsourcing with the brand “socially targeted sourcing,” this model is promoted as a 21st century solution to poverty that provides not only employment but equips workers with information and communication skills. In the words of the Rockefeller Foundation, social targeted sourcing generates both “financial and social value.” A report commissioned by the Rockefeller Foundation last year estimated that the market for microwork sourcing could rise to $20 billion by 2015.

Diagram mapping the locations of Impact Sourcing Service Providers, most operating in the global South. Source: Rockefeller Foundation.

Perhaps rather than questioning the distribution of tech wealth, we should question the terms of its production and forms of its global movements. The travels of tech wealth are dynamic, but profoundly uneven and unequal. As UC Berkeley MCP student Christina Gossmann shows, there even exists an extensive economy of electronic waste in the rubbish dumps of Kenya—a nation that is working to connect to streams of tech wealth by marketing itself as a potential “Silicon Savannah.” (Also see the Silicon Cape initiative in South Africa).

The eviction of working class families from San Francisco, and rise in inequality, should not be approached as a starting point, but rather as a symptom of a dangerous shift in production to rely heavily on tech wealth. The effects of this are not only domestic, but also unequally global, as this short article has suggested.

To quote artist and journalist Susie Cagle’s brilliant animation of the “class wars” in San Francisco: let’s stop talking about buses, “let’s talk money.”

Luis Flores is a Judith Lee Stronach Fellow at UC Berkeley and runs the Collective History Archive, an interactive oral history platform on debt, the recession, and the “New Economy.” He is a research intern at Causa Justa :: Just Cause. Luis can be reached at jr.luisf@gmail.com